Forty shades of green! Could it be true? When we stepped off the plane in Dublin, I noticed a sign at the airport touting Ireland’s 40 shades of green. It’s true! The Irish countryside is a patchwork of pastureland with greens of every shade imaginable. My husband, Bill, and I saw so much green on our drives through the countryside. We also saw other wonderful sights in Ireland. Here are some of my favorites.

Knock Shrine

The Knock Shrine, the site of a Marian apparition. In 1879, a group of villagers saw images of Jesus’ mother and father, Mary and Joseph, St. John the Evangelist, a lamb, and angels. Bill and I are faith-filled Catholics, and we connected to our Catholic brothers and sisters across time and space on our visit. We toured the museum, prayed a Rosary, attended Mass, and filled bottles with Holy Water for souvenirs.

Blarney Castle

Blarney Castle and Gardens is home to the famous Blarney Stone. Yes, Bill kissed the stone, so he gets the gift of gab – not that he needed it. I didn’t, so I’m still the quieter one in the family.

Cliffs of Moher

The Cliffs of Moher and other oceanside hikes where the scenery was breathtaking. Photographs don’t capture the immensity of the cliffs, the cawing of the sea gulls, or the wind whipping all around. Some of the hikes were steep and long, but the treks were worth it to see the astounding cliffs of Ireland.

St. Patrick’s Church

St. Patrick’s Church, Christ Church Cathedral, and St. Mary’s Cathedral (Killarney). Big, beautiful, and ancient churches that date back long ago. I’m so glad that people throughout the ages preserved these mighty churches for us to see today.

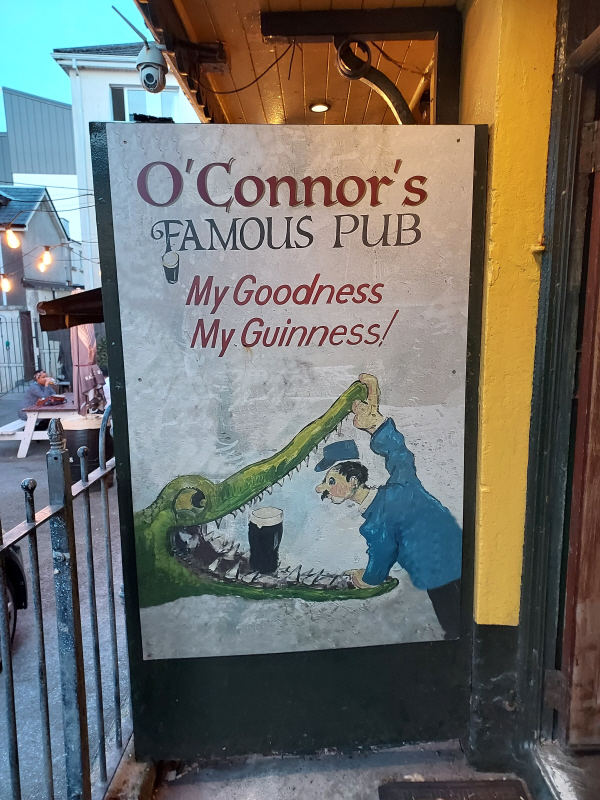

Irish Beer

Of course, another wonderful sight was a pint of Guinness at an Irish pub in the evening. Our Airbnb was a block away from a pub stuffed with antiques from floor to ceiling and live, traditional Irish music every night. What a great find!

A Surprise Favorite

One of my favorite sights was actually a road sign. The Irish have a caution sign that really got my attention. It’s a diamond-shaped sign with a giant exclamation mark. The sign warns drivers to watch for issues like the flooding or hidden driveways. The grammar geek in me loved seeing the road sign with the punctuation mark.

Home from Ireland

Isn’t that the type of person you want writing for your organization? Someone who loves working with words? I’ve been correcting people’s grammar since I was a kid, and I turned that annoying tendency into a career. As much as I loved Ireland, it’s good to be home and back to my writing.